Join me and other tutors at Learn Ealing's Fun Fair on 12 April 2023 from 10am-2pm for our FREE Curb the Cost Learning Fair at Everyone Active Acton Centre High Street Acton London W3 6LE, to help you acquire vital skills to effectively manage your finances and much more. Organised by Learn Ealing, the council’s adult learning team, both adults and children* can join us for different maths fun fair workshops, games and family learning activities - so you can bring the whole family with you. Learn how to Be Smart with Money and gain essential skills to help you manage your finances. Learn about your relationship with money and how it influences your saving and borrowing habits. Are you tired of high energy bills? Join our Smart Meter workshop and discover practical tips to reduce your energy consumption at home. Join our Go Compare workshop and discover how to save money on food without sacrificing nutrition or flavour. Learn to compare the costs of restaurant and fast food meals with the cost of cooking the same foods at home. Identify ways to provide healthy meals for your family while reducing your grocery bill. Get ready for some family fun with our Fun with Maths workshop. Join us to discover how you and your children can boost your confidence in maths through interactive games and challenges. Enjoy quality family time while learning essential maths skills and strategies. Come to our FREE Curb the Cost Learning Fair and don't miss out on this opportunity to make maths enjoyable and accessible for everyone. Reserve your place here Say Hello at the Ealing Biz ExpoCurrency Services will be exhibiting at the Cash for Invoices Limited stand at the Ealing Biz Expo on 8 March 2023 from 10am - 4pm. Location: stand 32 Weston Hall, University of West London, W5 5RF

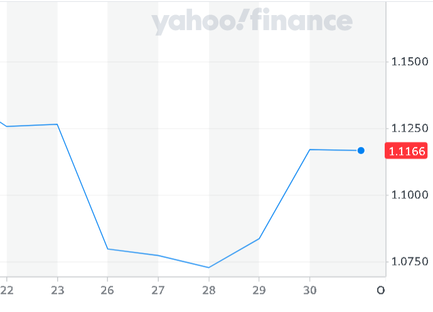

Come and meet and find out about how Currency Services can help you avoid currency losses. Get a free quote to see if Currency Services can get you a better rate for exchanging currencies or transferring currency more cheaply internationally. Also ask about getting a short-term urgent cash injection for your business using one or more of your invoices. A quote is free and without obligation. Cash for Invoices Limited of Chiswick London is an invoice finance company that specialises in buying single invoices off an SME in exchange for upfront cash. Unlike other providers, Cash for Invoices Limited only charges ONE fee, and gives the SME these other benefits: NO commitment on you to sell further invoices NO arrangement fee NO facility NO charge over assets and NO debt Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. What is an invoice? Invoices are a form of trade receivable, i.e., they are an asset on a company's balance sheet representing money to be received by that company at some future date - at the time the debtor pays the invoice. At that time, the debtor (payer of the invoice) will no longer appear on the company's balance sheet and instead it will be replaced by an equal amount of cash (which is also an asset). There is no net increase or decrease in assets, merely conversion from one to another. According to Yahoo Finance, "The pound has slid to its lowest level this week as downbeat economic data and the prospect of political uncertainty increased nervousness in the financial markets...The pound had a strong Thursday as it moved higher following Liz Truss’s announcement that she will resign as Prime Minister following a 44-day spell in charge which resulted in turmoil across the markets."

The chart below shows £1:$ in week ending Fri 21 Oct 2022 (Yahoo Finance)  According to EUBusiness, the release of better than expected UK GDP numbers (UK growth in Q2 was 4.4% versus an expected 2.9% growth), plus the intervention on Wednesday by the Bank of England and its short term Gilt buying programme, helped GBP appreciate and recover some of its lost value against USD. The options market, however, suggests there is still a 30% chance that GBP USD could fall below parity by year end. The chart opposite (YahooFinance), shows £1:$ in the last week of Sep 2022, and the depreciation of £ to $1.07 followed by its swift appreciation to $1.12 GBP USD Parity will mean higher costs in GBP for UK importers, so lower corporate profits where these costs cannot be fully passed on to consumers. Higher consumer prices means inflation and that will probably deter spending, which will lead to further drops in corporate profits. Higher inflation could mean more increases in interest rates by the UK central bank, putting further pressure on heavily-indebted companies and consumers, and adding to the interest to pay on higher UK government debt announced by the UK government in its recent mini-budget. Currency risk is not going to go away and is likely to warrant closer attention by companies and individuals exposed to the risks of paying too much or receiving too little for their currency transactions. Contact Currency Services today for a free no-obligation consultation on your business or personal currency transactions ...but they still have a lot of value to recoverBoth currencies have depreciated over the year against the USD and have a long way to go before they recover all of their lost value.

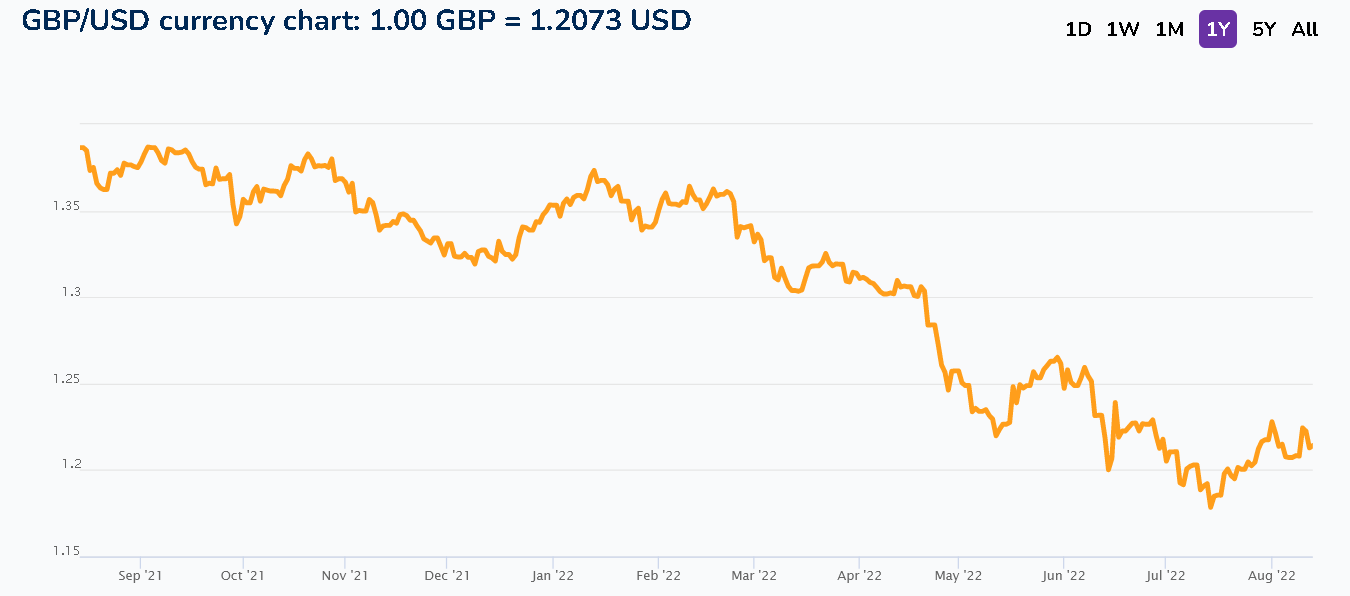

The charts below from OFX show the Pound and Euro started their climb back in July 2022 but that has started to go sideways in August for the Pound. Both currencies could fall back again (depreciate against USD) if the US Fed raises its rates again in September, piling on more pressure for EU and UK importers paying for their goods in USD. For independent guidance on currency risk management and currency transfers, contact me for a free no-obligation discussion. Inflation and recession risk continue to weigh on currency marketsThe USD has been declining in the week ending 12 August 2022 but staged a rebound against the Euro, Yen, and Pound on Friday, reports Reuters. There remains a significant probability of a 75bp hike in interest rates by the Fed in September to combat stubborn inflation, though a 50bp rise is considered more likely..

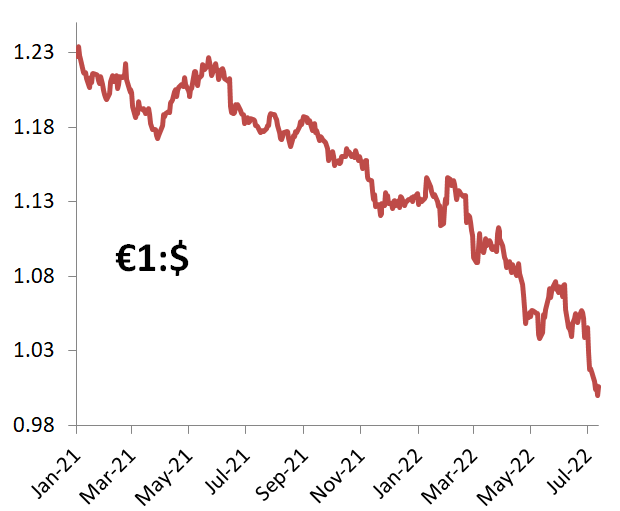

The $ appreciated on Friday against the Pound ($1.2141) and against the Euro ($1.02625) and against the Yen (Yen133.495). If Commerzbank is right, there are costly times ahead for European businesses importing from the US (and paying in $). The bank has forecast the Euro will depreciate to $0.98 by December 2022. A year earlier the rate had been $1.18318 according to OFX On a $10000 import, that means an extra €1,753 to pay just to convert the currency. For independent guidance on currency risk management and currency transfers, contact me for a free no-obligation discussion. Not least of which is a higher cost of servicing USD debtThe Financial Times highlighted the many reasons why an appreciation of the USD is bad news for Emerging Market countries (EMs), by which they mean, developing countries.

If you are involved in import or export (not only to or from EMs) and you wish to discuss how to manage your currency transfers or hedge the associated currency risks, then contact me for a free no-obligation discussion. 28/7/2022 What moves currency markets?Many factors and not to the same degree or speedHere is a rundown of major factors (based on an article by Finance Magnates). There are other factors, such as disease (think of the impact caused by Covid on global trade and currency flows, economic output, and travel).

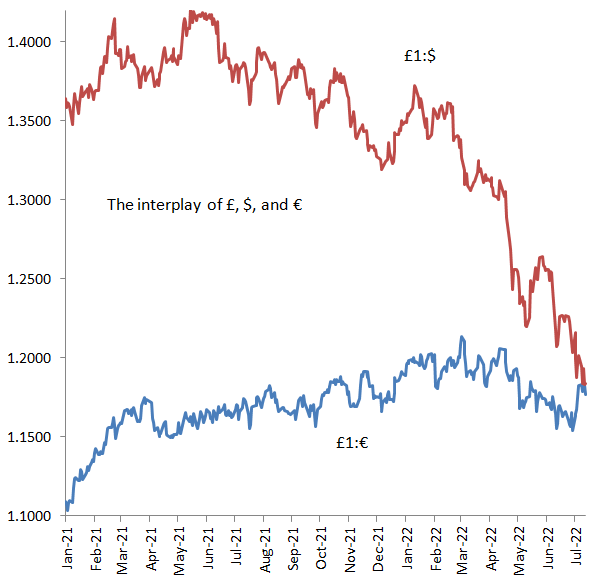

Some factors will have a relatively greater impact, or act relatively less quickly, than others. Employment (high employment supports GDP) GDP (a strongly-growing economy is attractive so its currency appreciates) Interest rates (higher interest rates tend to cause the currency to appreciate, e.g., the USD in 2022) Inflation Imports versus Exports (more exports favours appreciation of the exporter's currency) Politics (e.g., capital controls, supporting a currency, currency pegging, fiscal and monetary policies, budget deficits, austerity policies, trade deficits, public sector debt, corruption) Conflict (war) Environment (e.g droughts, wildfires, hurricanes) Volatility Consumer and Business confidence To discuss your currency transfers and how you might be able to hedge currency risks, contact me for a free no-obligation discussion. 28/7/2022 Hedging currency risk is not cashlessMargins required to cover credit riskA business operating internationally faces many financial risks, not least currency risk. A common derivative to hedge (protect) this risk is a forward contract. Whilst a forward contract can provide simple and effective protection against the future adverse movement of the currency, it is likely to come at a cost to the business - cashflow. The counterparty might require an upfront payment from the company in case it defaults on its obligation to pay future currency under the forward contract. Further margin payments might be required from the company (more cash outflow) if the exchange rate moves adversely. It is important therefore for businesses trying to manage their currency risks that upfront and interim cash payouts might be required by their counterparties and they should therefore ensure they can withstand such outflows in the period up to the currency cashflow being hedged. In managing one risk (currency), another risk (liquidity) can be created. To discuss your currency risks, and how to hedge them with forwards or other instruments, contact me for a free no-obligation discussion. The currency risk implications for UK and EU businessesRef: Charts by P Singh using data derived from currency data supplied by the ECB The first chart above shows that in July 2022, the € depreciated to €1:$1.00 (Parity), reflecting the currency market's fears over the adverse effects of inflation, recession, interest rates, soaring energy prices and energy rationing, on businesses and consumers across the Eurozone. As is often the case, the US economy and $ assets have been seen as relatively safe havens during geopolitical tensions and market volatility, and so the flight to buying the $ in preference to the €. The second chart above shows how the UK Pound has appreciated against the € but, like the €, has depreciated against the $, for the same reasons cited above for the €, except perhaps that the UK is not as dependent as the EU has become, on Russian oil. Currency volatility and the consequences of not hedgingWhat does currency volatility mean for businesses that do not hedge? In a word, risk.

Risk of generating less cash than expected, which can lead to pressure to pay creditors as they fall due, breaches of covenants, inability to tender for contracts or to fulfil existing contracts, inability to pay staff, or to pay for stocks. In addition to the negative cashflow, reported earnings can fall, which can send out the wrong signals to potential lenders, trade suppliers, and customers. Auditors might refuse to sign-off accounts if they have doubts about the going-concern status of the business or its ability to provide working capital for the next year. Without audited accounts, suppliers might reduce credit terms or insist on cash on delivery. Lenders might charge higher interest rates, insist on greater security, refuse to lend, or call in their loans. Employees might abandon ship, lose morale, or refuse to take a cut in salaries to conserve cash. Redundancy costs can be expensive and a further drain in cashflow. To discuss your currency risks or currency transfers, contact me now, without obligation or charge. A currency hedge that guarantees protection plus a share of any upsideThe Forward Extra, introduced in a previous post, offers the holder the chance to gain from a favourable movement. That gain could be nothing, something, or 100%, depending on where the exchange rate moves.

A Participating Forward currency contract gives the holder some return no matter how favourably the exchange rate moves in future. Unlike the Forward Extra, the Participating Forward gives a limited return, the participation rate. How does a Participating Forward contract work? Say the participation rate is 60%, then in essence, the company gets the benefit of 60% of the favourable movement in the exchange rate. As there is nothing free in finance, for the chance to gain additional income, or to reduce the future payout, the business purchasing the Participating Forward does so at a contracted forward rate that is slightly worse than the market rate for a straight forward contract. If the exchange rate moves favourably, then (assuming a participation rate of 60%), the business will transact 60% of the contract at the favourable market rate and 40% at the contracted forward rate. The average rate will, in this example, therefore be more favourable than the market forward rate had the business decided to use a conventional forward contract to hedge its currency risk. To discuss your currency risks or currency transfers, contact me now, without obligation or charge. Guaranteed currency protection with the potential for extra incomeBusinesses that trade internationally often choose forward contracts to hedge the risk of unfavourable currency exchange rates in the time period from invoice to settlement of the transaction, which could be months in future.

Though very simple and effective, forward contracts are inflexible because they do not allow businesses to benefit if the exchange rate moves in their favour. The Forward Extra currency contract is an innovation that overcomes the inflexibility of conventional forward contracts. In essence, for accepting a slightly worse forward rate than the market forward rate on a conventional forward contract, the business gets the opportunity to earn 100% of any favourable movement in the exchange rate up to the expiry date of the Forward Extra contract. In addition to the slightly worse forward rate, the business accepts that it will get 0% of any favourable movement in the exchange rate up to the expiry date of the Forward Extra contract, if the favourable exchange rate movement exceeds a knock-out trigger level at any time up to the settlement date or (for a European-style Forward Extra) on the expiry date of the Forward Extra contract. For example, suppose a business is due to pay a $ invoice in 3 months. It has to exchange its £ for at least £1:$1.50 The 3 month forward is £1:$1.52 It enters into a 3-month Forward Extra with a forward rate of $1.50 and a knock-out trigger rate of $1.55 that may be triggered at anytime (an American-style option). If on the expiry date the spot rate is $1.48, it will receive $1.50 If on expiry the spot rate is between $1.50 and $1.55, it will receive the spot rate If at any time up to the expiry date the rate is at $1.55 or above that (e.g $1.60), then it will convert on the expiry date at $1.50 forward rate. The Forward Extra works best if the business's forecast of the maximum level of the future exchange rate is accurate, because if, in this example, the $ depreciates more than forecast (more than $1.55) the business gets none of the benefit of the depreciation up to $1.55 While it loses the upside it is guaranteed protection in case the $ appreciates below $1.50 To discuss your currency risks or currency transfers, contact me now, without obligation or charge. Hedging currency risk with a range forward currency contractBusinesses that are loathe to pay the upfront premium when buying a vanilla currency option can reduce that cost partly or completely, using a range forward currency option or contract.

In essence it involves the purchase of an option whose premium cost is offset by the premium income from selling another currency option. For example, a UK business exposed to the appreciation of the USD (e.g., it has to make a payment on a specific date in the future) can hedge its exposure by buying a USD call option thereby guaranteeing it will receive no less than the $ strike rate (e.g., $1.50) if the $ appreciates (to say, $1.25). To pay for the premium, it can sell a USD put option (at a strike of say $1.75). If on the payment date the $ has depreciated beyond this (e.g. to $1.80) then the company will receive in effect $1.75 not the more favourable $1.80 If the $ spot rate at maturity is in the range $1.50 to $1.75, the business uses the prevailing spot rate. To find out how to use Range Forwards or other currency hedging instruments to manage your business's currency risks, contact Permjit Singh for a free chat without obligation. Joining forces with a currency specialist to support businessesCurrency specialist, Currency Services, announces a partnership with a leading currency transfer and currency risk specialist to support businesses with their currency transfers and currency risk.

The partnership is a natural extension of the company's domestic trade invoice finance service, i.e., to now offer a service that offers to hedge the currency risk of foreign trade invoices, or facilitate the international transfer of currencies. With inflation and interest rates significantly impacting exchange rates (the € has now reached parity with the USD, for example) and recession looming in the UK and EU continent, now is the time for corporates to pay attention to, and manage, their currency risks and transfers. This partnership has therefore been forged at an opportune moment given the financial distress many companies are experiencing or will experience from currency market, supply chain, and geopolitical turbulence. "There is no additional cost to your business of executing currency hedges or currency transfers through this partnership versus solely with the currency specialist. On the contrary, you get the benefit of two independent financial risk management businesses putting their heads together to create a bespoke currency solution just for you.", says Currency Services How can invoice finance help farmers? Permjit Singh Treasury Consultant finds outBringing supply chains on-shore - for example by Nutella relocating from Turkey - might upset the environment and local ecology, reports the FT. Changes to the supply chain will certainly consume capex and working capital, says Cash for Invoices Limited - the single invoice buyer.

Farmers in Italy and Turkey affected by the supply chain shift of Nutella could each benefit from using invoice finance to finance the increase in demand for cash, says Cash for Invoices Limited. Farmers will need cash to build the local infrastructure to supply Nutella. Other will need cash to offset reduced crop production and sales if growing hazelnuts locally reduces yields of other crops or necessitates additional expense. Farmers in Turkey will need cash to offset the loss of revenue from no longer supplying hazelnuts to Nutella. Invoice finance is a readily-available source of cash for working capital but it is only available to businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. It can also be used for capex though less readily. Cash for Invoices Limited of Chiswick London is an invoice finance company that specialises in buying single invoices. An SME can sell one or more of its trade invoices to Cash for Invoices Limited for cash. Unlike other providers, Cash for Invoices Limited only charges ONE fee, and gives the SME these other benefits: NO commitment on the SME to sell further invoices NO charge over assets NO debt NO arrangement exit, maintenance or other fees other than a simple single charge for the cash paid in advance of the invoice payment date and NO financing facility Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. To find out more contact Cash for Invoices Limited here. How can invoice finance help Easyjet? Permjit Singh Treasury Consultant finds outEasyjet should use invoice finance not just cost-cutting or novel ways to extract more money from air passengers, to recover the cash element of its £2bn pandemic loss (reported in the FT), says Cash for Invoices Limited - the single invoice buyer.

Invoice finance is a readily-available source of cash for working capital but it is only available to businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. It can also be used for capex though less readily. If Easyjet runs B2B services, such as cargo shipping and business travel, then it might issue invoices, but they are not going to invoice their retail passengers Cash for Invoices Limited of Chiswick London is an invoice finance company that specialises in buying single invoices. An SME can sell one or more of its trade invoices to Cash for Invoices Limited for cash. Unlike other providers, Cash for Invoices Limited only charges ONE fee, and gives the SME these other benefits: NO commitment on the SME to sell further invoices NO charge over assets NO debt NO arrangement exit, maintenance or other fees other than a simple single charge for the cash paid in advance of the invoice payment date and NO financing facility Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. To find out more contact Cash for Invoices Limited here How can invoice finance pay for advertising? Permjit Singh Treasury Consultant finds outConsumer product sellers continue to spend on advertising even though product input costs are rising (inflation) (reports the FT). In other words, ads are not being forsaken because of rising inflation and the need to contain operational costs, says Cash for Invoices Limited - the single invoice buyer.

Regrettably, some advertisers and their advisers don't know whether the cost of specific advertising is worth it in terms of revenue generated. What is certain is cash is being spent to run such campaigns. Invoice finance is a readily-available source of cash for working capital needs such as funding advertising campaigns, and it can fill the gap before revenues are received in cash. Invoice finance is only available to businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. It can also be used for capex though less readily. It's likely advertisers will not pay in cash but by invoice, so the advertising agents can sell those invices for cash to fund their other projects and their working capital. Cash for Invoices Limited of Chiswick London is an invoice finance company that specialises in buying single invoices. An SME can sell one or more of its trade invoices to Cash for Invoices Limited for cash. Unlike other providers, Cash for Invoices Limited only charges ONE fee, and gives the SME these other benefits: NO commitment on the SME to sell further invoices NO charge over assets NO debt NO arrangement exit, maintenance or other fees other than a simple single charge for the cash paid in advance of the invoice payment date and NO financing facility Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. To find out more, contact Cash for Invoices Limited here. How can invoice finance help landlords? Permjit singh Treasury Consultant finds outThe FT reports that retail and hospitality landlords have suffered cashflow shortages during the pandemic, but office space landlords continue to get their rents from tenants whose offices even though their offices are empty because of homeworking.

For both types of landlords and retail and hospitality landlords especially, invoice finance is not an option to generate cashflow. That is basically because their business models do not involve regular issues of invoices for payment of rent, says Cash for Invoices Limited - the single invoice buyer. Invoice finance is a readily-available source of cash for working capital to businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. Asset securitisation would be an option for the bigger landlords. Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. To find out more contact Cash for Invoices Limited here. What is disrupting the supply chain? Permjit Singh Treasury Consultant finds outThe global shortage of container ships is adding to supply chain disruption caused by a shortage of containers, reports the FT. The need to retool and redesign ships inline with environmental rules, will demand massive cash investment both initially and ongoing, says Cash for Invoices Limited - the single invoice buyer.

Invoice finance is a readily-available source of cash for working capital and capex needs of shipbuilders, and it can complement other sources of finance such as banking and capital markets, and money markets, says Cash for Invoices Limited. For the many freight companies flush with cash from charging high freight prices, invoice finance might be of less importance, but for the importers and exporters that pay those sky-high costs, invoice finance could stave off insolvency. Invoice finance is only available to businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. To find out more contact contact Cash for Invoices Limited here. Can invoice finance help property landlords? Permjit Singh Treasury Consultant finds outThere will be a high cost to refurbish offices to make them comply with new UK energy efficiency rules starting 2023, reports the FT. For some big property owners, it will means spending hundreds of £ millions in cash on upgrading their unfit buildings.

Landlords already struggling to collect rent from retail tenants and so short of cash, could get deeper into financial distress and face a cash crisis, warns Cash for Invoices Limited - the single invoice buyer. Invoice finance is a readily-available source of cash for working capital and capex needs of many businesses, and it can complement other sources of business finance such as banking and capital markets, and money markets, says Cash for Invoices Limited. Invoice finance is only available to businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. Cash for Invoices Limited explains how single invoice finance works: What is invoice finance Cash for Invoices Limited of Chiswick London is an invoice finance company that specialises in buying single invoices. An SME can sell one or more of its trade invoices to Cash for Invoices Limited for cash. Unlike other providers, Cash for Invoices Limited only charges ONE fee, and gives the SME these other benefits: NO commitment on the SME to sell further invoices NO charge over assets NO debt NO arrangement exit, maintenance or other fees other than a simple single charge for the cash paid in advance of the invoice payment date and NO financing facility Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. To find out more about Cash for Invoices Limited's single invoice finance service, contact Cash for Invoices Limited here What is invoice finance? Permjit Singh Treasury Consultant finds outCinema owners are exposed to immediate streaming of new film releases and to those new releases being box office flops. On top of that, they are under pressure from Wall St pressuring film studios to stream immediately on release (FT).

Just like other cash-based consumer-facing sectors such as High street retailers and hospitality, companies cannot fall back on invoice finance to generate cash when the revenue dries up, says Cash for Invoices Limited - the single invoice buyer. Invoice finance is a readily-available source of cash, but only for businesses that trade on credit, meaning they issue invoices to their customers for future payment of goods and services sold. Cash for Invoices Limited explains how single invoice finance works: What is invoice finance? Cash for Invoices Limited of Chiswick London is an invoice finance company that specialises in buying single invoices. An SME can sell one or more of its trade invoices to Cash for Invoices Limited for cash. Unlike other providers, Cash for Invoices Limited only charges ONE fee, and gives the SME these other benefits: NO commitment on the SME to sell further invoices NO charge over assets NO debt NO arrangement exit, maintenance or other fees other than a simple single charge for the cash paid in advance of the invoice payment date and NO financing facility Cash for Invoices Limited of London offers a simple, transparent and flexible invoice finance service that helps the SME or sole trader get the essential cash they need. What is an invoice? Invoices are a form of trade receivable, i.e., they are an asset on a company's balance sheet representing money to be received by that company at some future date - at the time the debtor pays the invoice. At that time, the debtor (payer of the invoice) will no longer appear on the company's balance sheet and instead it will be replaced by an equal amount of cash (which is also an asset). There is no net increase or decrease in assets, merely conversion from one to another. Bad debt? If that debtor does not pay the invoice bought by Cash for Invoices Limited, then the asset (the invoice) will be written off as a bad debt (a cost in the profit & loss account) and invoice assets (trade receivables) will then reduce ( because no cash came in from the invoice debtor). Granting time (credit) to buyers (by the SME) to pay for their purchases is therefore an example of credit risk for the SME that gives customer time to pay for goods or services. If later - perhaps through credit collection procedures - the debtor pays the invoice, then the bad debt is added to the profit & loss account as a profit (income) and cash increased by the amount received. The assets (cash) increase and are offset by an increase in profit (equity on the balance sheet). All is well again. Selling an invoice to Cash for Invoices Limited Cash for Invoices Limited is a provider of cash and is not a debt collector, so it only buys SME invoices that are not in default, i.e., where the debtor has failed to pay the invoice. Before the debtor defaults, the SME can sell the invoice to a single invoice finance buyer - such as Cash for Invoices Limited. The SME wants to exchange an invoice for cash - perhaps it needs the cash sooner than the invoice payment date. Cash for Invoices Limited will consider the offer and if accepted will provide a Quote of the terms and conditions of the invoice that the SME wants to sell. There is no commitment for the SME to sell, and no commitment for Cash for Invoices Limited to buy the invoice on offer for sale. Cash for Invoices Limited will make an offer after conducting due diligence on the selling company and on the debtor especially. The debtor is a key concern for Cash for Invoices Limited because if there is a subsequent default in payment of the invoice, then Cash for Invoices Limited will not require the seller to buyback the invoice. The invoice sale is therefore non-recourse (except where the SME's owner or director(s) and so Cash for Invoices Limited has to suffer the consequences of a default. Cash for Invoices Limited has the right to commence steps to recover the debt. These can include issuing letters for payment, appointing a solicitor, making a court claim, or making a claim under a credit insurance policy. Personal Guarantee in the event of invoice default Cash for Invoices Limited might require a personal guarantee of the director(s) of the SME who is selling the invoice, in case the invoice sold is not repaid by the debtor. Retention to mitigate credit risk To mitigate the potential costs of trying to recover payment on an invoice that Cash for Invoices Limited purchased but which goes into default, Cash for Invoices Limited will retain up to 10% of the value of that invoice from the purchase price. If there is no default (the debtor pays the invoice on time and in full) then Cash for Invoices Limited will pay the full amount of the retention to the seller when the debtor pays the invoice. Features of single invoice finance offered by Cash for Invoices Limited In addition to being non-recourse (except where a personal guarantee is provided), Cash for Invoices Limited does not require a commitment from the seller to sell all its invoices, nor will Cash for Invoices Limited charge an arrangement fee for a purchase. Cash for Invoices Limited will not ask for ongoing fees because there is no facility between the seller and Cash for Invoices Limited. The transaction is entered into whenever the SME needs cash and Cash for Invoices Limited agrees to purchase the single invoice or multiple invoices. Compared to bank factoring facilities, Cash for Invoices Limited's single invoice finance service is far more simple and has no tie-ins and far fewer fees, in fact, just one fee. Cash for Invoices Limited's single invoice finance service therefore helps companies (sole traders, SME, charity, social enterprise, and limited partnerships) who have trade invoices and need cash. To find out more about Cash for Invoices Limited's single invoice finance service, contact Cash for Invoices Limited here Cash for Invoices Limited will consider buying invoices where the SME and its debtor are located in Ealing, Hounslow, Hammersmith, Richmond, Kingston, Harrow, Acton, Brentford, Chelsea, Kensington, Holland Park, Barnet, and the north, south, centre, and east of London. Cash for Invoices Limited will also consider invoice purchase from other parts of the UK. Why is netting important? Permjit Singh Treasury Consultant finds outThe previous post said it is hard enough for a business to making money, without wasting it on unnecessary bank charges so any process that can reduce a company's bank charges is welcome by a corporate treasurer. Payment netting is one such process.

In essence, money paid out of bank accounts held at a company's subsidiaries can be netted off so the number of payments is smaller, or there might be no payment to make on a net basis. Netting enables a company to reduce its number of payments and so reduce its bank payment charges, which saves money and so increases cashflow and profits. With a multinational company making tens of thousands of transfers to and from its dozens of subsidiaries across the globe, the savings for a Treasurer from netting those domestic and international cash transfers can run to the £millions per annum. There will also be a substantial saving of time from the reduced number of payments. Of course, care needs to be taken to comply with tax, accounting, and local rules governing netting of cross-border payments, and transactions should be conducted on commercial terms between subsidiaries. To discuss Cash or Treasury management for your company, including interim Treasury management, funding, and financial risk management, contact me for a free, confidential chat without obligation. Why are cash pooling and netting important? Permjit Singh Treasury Consultant finds outIt is hard enough for a business to make money, without wasting it on unnecessary bank interest charges, so any process that can reduce a company's overdraft charges or better still, generate additional interest, is welcome by a corporate treasurer. Cash pooling is one such process.

In essence, bank accounts held at a company's subsidiaries can be stand alone so any surplus earns interest, usually peanuts, such as 0% or 0.1% per annum. Any overdraft is charged interest, usually a very high rate, such as 8%pa. To avoid paying overdraft interest, stand alone bank accounts should be pooled and netted off each day for interest calculation purposes. That way, the company avoids overdrafts or reduces them by the amount of surplus cash it has on some of its accounts. A simple example will illustrate the savings to be made from cash pooling: A company subsidiary (A) has an overdraft of £100K and is charged 8%pa overdraft interest, so £8K per annum. Subsidiary B however always has a surplus of at least £100K on its bank account. It earns a generous 1%pa (£1K). By pooling the two accounts, the company will avoid paying £8K overdraft interest per annum, and make a net saving of £7Kpa. With multinational companies holding thousands of bank accounts across dozens of subsidiaries across the globe, each with surpluses or deficits of cash, the savings for a Treasurer from effective international cash pooling can run to the £millions per annum. To discuss Cash or Treasury management for your company, including interim Treasury management, funding, and financial risk management, contact me for a free, confidential chat without obligation. What is it? Permjit Singh Treasury Consultant finds outRunning out of cash (liquidity risk) is a Treasurer's primary concern among the financial risks faced by their company, ahead of interest and currency risk.

This is simply because without cash, a company cannot survive. The cashflow statement provides the treasurer with a useful summary of where a company's cash has come from and where it has gone, over a period of time, such as a financial year. It has three sections: cash from operations, cash from investing activities, and cash from financing activities. A summary section shows the cash at the start of the period, the net increase or decrease in cash during the period, and the cash at the end of the period. The P&L and Balance sheet statements are the source of the data for the cashflow statement. To discuss Cash or Treasury management for your company, including interim Treasury management, funding, and financial risk management, contact me for a free, confidential chat without obligation. What is the biggest challenge in managing working capital? Permjit Singh Treasury Consultant finds outAccording to a survey by Treasury Strategies, a division of Novantas, the most common obstacle to optimising working capital for Treasurers is the quality of data used (for forecasting). As the saying goes "garbage in, garbage out". The next biggest challenge for treasurers was forecasting accurately when their customers (debtors) will pay. Part of the problem is knowing who will not pay cash owed on the due date (default) and what percentage will never pay the cash (resulting in a write-off).

For some treasurers, variance analysis was their biggest challenge. This process involves analysing the difference between what working capital balances were forecast and what balances actually occurred, and understanding why the differences arose and trying to reduce them in future. Some treasurers might be hampered in managing their working capital by relying on indirect working capital forecasting methods prepared by FP&A versus preparing them within Treasury and using the direct and simpler Receipts and Payments method of cash forecasting. Poor working capital management caused by poor cash forecasting can result in significant amounts of cash unnecessarily tied up in a company's working capital, such as its debtors or over-stocking. That cash could be better deployed in producing positive cashflow or reducing interest unnecessarily being paid on debt outstanding. To discuss Cash or Treasury management for your company, including interim Treasury management, funding, and financial risk management, contact me for a free, confidential chat without obligation. |