Welcome to Currency Services

Clarity Value Trust

Treasury Consulting

Treasury consulting

I understand the varied and changing financial needs of a business and I am therefore able to offer a set of complementary corporate treasury consulting services, including

I have worked as a treasurer in large companies and been involved in SMEs and sole trader funding. I also established a limited company and used it to acquire and run a business that I subsequently sold.

- establishing a corporate treasury

- Optimisation of international and domestic bank accounts, and cash netting or pooling across banks

- managing counterparty relationships

- evaluating financing

- risk management (interest rate, currency, liquidity, commodity, and credit)

- interim treasury management, and

- ESG in Treasury

I have worked as a treasurer in large companies and been involved in SMEs and sole trader funding. I also established a limited company and used it to acquire and run a business that I subsequently sold.

Establishing or reorganising a Treasury

Establishing or reorganising a Treasury

As your company grows, its funding needs and risks will become greater, more complex, and more time-consuming, possibly necessitating the establishment of a dedicated treasury department.

Alternatively, your business might have been part of an established company but has been spun-off into a separate company through a buyout or private equity transaction, and you need dedicated resource to establish (or reorganise) a treasury function, often very quickly.

Your company might be in financial distress, insolvent, or attempting a distressed turnaround and you need urgent help resolving creditor disputes, renegotiating credit agreements, seeking waivers or grace periods, selling assets to raise essential liquidity, or liaising with the Receiver, Administrator, or Liquidator

I have the experience and knowledge to identify your specific treasury needs, devise a plan, and achieve a successful outcome.

Alternatively, your business might have been part of an established company but has been spun-off into a separate company through a buyout or private equity transaction, and you need dedicated resource to establish (or reorganise) a treasury function, often very quickly.

Your company might be in financial distress, insolvent, or attempting a distressed turnaround and you need urgent help resolving creditor disputes, renegotiating credit agreements, seeking waivers or grace periods, selling assets to raise essential liquidity, or liaising with the Receiver, Administrator, or Liquidator

I have the experience and knowledge to identify your specific treasury needs, devise a plan, and achieve a successful outcome.

Interim Treasury management

Interim Treasury management

Occasionally your treasury department will experience a shortage of staff. This can leave you exposed.

Alternatively, your treasury will need to consider and respond to a new activity, proposal, or direction, often under time constraints.

I can provide interim management, whether to cover for staff absence or to undertake ad hoc tasks.

My experience enables me to help you whether the need is sorting out a backlog of deal confirmations, or managing a treasury department.

Alternatively, your treasury will need to consider and respond to a new activity, proposal, or direction, often under time constraints.

I can provide interim management, whether to cover for staff absence or to undertake ad hoc tasks.

My experience enables me to help you whether the need is sorting out a backlog of deal confirmations, or managing a treasury department.

Financial Risk Management

Financial Risk Management

Many profitable companies fail through poor financial risk management.

I offer an independent and objective assessment of your key financial risks:

Financial risk management

I offer an independent and objective assessment of your key financial risks:

Financial risk management

- Liquidity, Interest, Currency, Credit, Commodity, and Operational risks

- Overall treasury health-check

- Controls, procedures, and policies

- IT integrity and disaster recovery

- Currency and interest rate risk hedge design, execution, and valuation

- Capital structure and composition.

- Working capital efficiency

- Investment strategy

- Environmental Social Governance (ESG)

Invoice Finance

Invoice Finance from Cash for Invoices Limited

Many profitable companies fail because they run out of cash.

I offer single invoice finance through Cash for Invoices Limited to meet the short-term cash needs of your business.

Invoice finance from Cash for Invoices Limited has the following benefits over conventional invoice finance:

How does it work?

For a free no-obligation quote for your single invoice, contact me

I offer single invoice finance through Cash for Invoices Limited to meet the short-term cash needs of your business.

Invoice finance from Cash for Invoices Limited has the following benefits over conventional invoice finance:

- No obligation on you to sell any invoice

- You pay just one fee for the service, so no exit, arrangement, annual, or other fees

- No financing facility. Just raise cash from an invoice on a pay-as-you-go basis - when you need the cash

- No security over your other business assets. A personal guarantee will be needed

- Small value invoice finance - sell an invoice with a face value starting from just £300

- Pay a single fee for the service and nothing more, and starting from just 1.99% per month+VAT

- Charities, start-ups, social enterprises, not-for-profits, and sole traders are welcome to apply.

- Most business sectors and most regions will be considered for invoice finance

How does it work?

- Offer an invoice for sale

- Get a decision in principle

- Complete an application form

- Inform your customer

- Sell your invoice

- Receive your cash

For a free no-obligation quote for your single invoice, contact me

Creditsafe rates Cash for Invoices Limited "Very Low Risk"

Currency transfers and hedging

Profitable companies can lose cash or make less profit because they don't recognise or properly manage their currency risks.

They can also lose significant value by not choosing the right currency service provider for their needs. A survey carried out for currency specialist OFX, showed that 80% of consumers were unaware of high bank margins on currency conversions. According to OFX, these margins equate to roughly $500 on a $10,000 transfer.

Another currency specialist, MFX, came to a similar conclusion about banks and their currency exchange rates, saying: "with a £10,000 transaction to US dollars, banks could add a margin of up to 5 per cent on the interbank rate, in addition to their transaction fee".

But don't think you'll get your currency converted or transferred for free with a currency service provider. They are, like banks, out to make money from the service they provide to you.

That money could be from charging you a margin (smaller than banks charge, but not necessarily smaller) when converting your money, from the fee you pay them to transfer your money (again, not necessarily smaller than charged by banks), or just for referring you to their outsourced currency service provider.

With so many currency service providers and intermediaries to choose from, in addition to the banks, it can seem daunting to know which one is the optimum for you in terms of service, product, and cost. That is where Currency Services can help.

They can also lose significant value by not choosing the right currency service provider for their needs. A survey carried out for currency specialist OFX, showed that 80% of consumers were unaware of high bank margins on currency conversions. According to OFX, these margins equate to roughly $500 on a $10,000 transfer.

Another currency specialist, MFX, came to a similar conclusion about banks and their currency exchange rates, saying: "with a £10,000 transaction to US dollars, banks could add a margin of up to 5 per cent on the interbank rate, in addition to their transaction fee".

But don't think you'll get your currency converted or transferred for free with a currency service provider. They are, like banks, out to make money from the service they provide to you.

That money could be from charging you a margin (smaller than banks charge, but not necessarily smaller) when converting your money, from the fee you pay them to transfer your money (again, not necessarily smaller than charged by banks), or just for referring you to their outsourced currency service provider.

With so many currency service providers and intermediaries to choose from, in addition to the banks, it can seem daunting to know which one is the optimum for you in terms of service, product, and cost. That is where Currency Services can help.

Don't know what to do about your currency risk or a currency transfer?

Here are some pointers to get you started...

Don't... |

Do... |

bury your head in the sand, or close your eyes and hope you get a good exchange rate. |

ask me for an independent assessment of what your bank is proposing to you, at what cost, and on what terms and conditions. |

be a victim of pressure selling and be forced into buying hedging financial instruments as a condition of getting a loan (remember the interest rate swaps scandal?) |

get an alternative currency exchange rate quote. |

take the first currency exchange rate quoted by your bank |

contact me for a free initial consultation, without obligation |

think currency markets are forgiving |

ask me for clarification on currency jargon or currency risk management |

Staying afloat in a currency storm: the interplay of £, €, and $ exchange rates

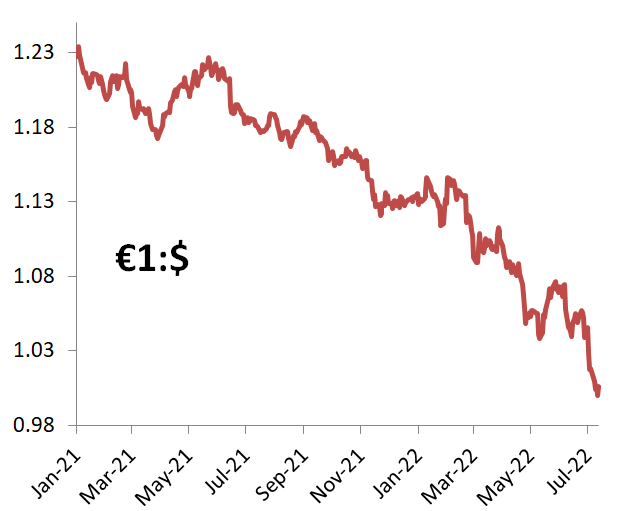

The first chart below shows that in July 2022, the € depreciated to €1:$1.00, reflecting the currency market's fears over the adverse effects of inflation, recession, interest rates, soaring energy prices and energy rationing, on businesses and consumers across the Eurozone. As is often the case, the US economy and $ assets have been seen as relatively safe havens during geopolitical tensions and market volatility, and so the flight to buying the $ in preference to the €.

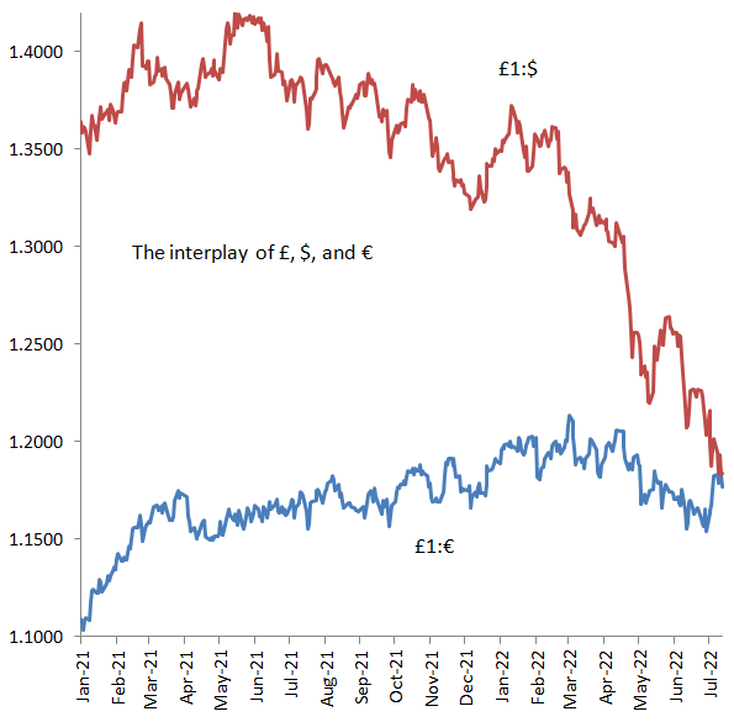

The second chart below shows how the UK Pound has appreciated against the € but, like the €, has depreciated against the $, for the same reasons cited above for the €, except perhaps that the UK is not as dependent as the EU has become, on Russian oil.

The second chart below shows how the UK Pound has appreciated against the € but, like the €, has depreciated against the $, for the same reasons cited above for the €, except perhaps that the UK is not as dependent as the EU has become, on Russian oil.

Ref: Charts by P Singh using data derived from currency data supplied by the ECB

Currency volatility and the consequences of not hedging.

What does currency volatility mean for businesses that do not hedge? In a word, risk.

Risk of generating less cash than expected, which can lead to pressure to pay creditors as they fall due, breaches of covenants, inability to tender for contracts or to fulfil existing contracts, inability to pay staff, or to pay for stocks.

In addition to the negative cashflow, reported earnings can fall, which can send out the wrong signals to potential lenders, trade suppliers, and customers.

Auditors might refuse to sign-off accounts if they have doubts about the going-concern status of the business or its ability to provide working capital for the next year. Without audited accounts, suppliers might reduce credit terms or insist on cash on delivery. Lenders might charge higher interest rates, insist on greater security, refuse to lend, or call in their loans.

Employees might abandon ship, lose morale, or refuse to take a cut in salaries to conserve cash. Redundancy costs can be expensive and a further drain in cashflow.

Risk of generating less cash than expected, which can lead to pressure to pay creditors as they fall due, breaches of covenants, inability to tender for contracts or to fulfil existing contracts, inability to pay staff, or to pay for stocks.

In addition to the negative cashflow, reported earnings can fall, which can send out the wrong signals to potential lenders, trade suppliers, and customers.

Auditors might refuse to sign-off accounts if they have doubts about the going-concern status of the business or its ability to provide working capital for the next year. Without audited accounts, suppliers might reduce credit terms or insist on cash on delivery. Lenders might charge higher interest rates, insist on greater security, refuse to lend, or call in their loans.

Employees might abandon ship, lose morale, or refuse to take a cut in salaries to conserve cash. Redundancy costs can be expensive and a further drain in cashflow.

Opportunity cost versus stability

Hedging removes risk of loss of cash and profit and so removes the adverse effects described above if exchange rates turn out to be unfavourable.

On the other hand, hedging could result in the company not getting the windfalls of more cash and more profit if exchange rates turn out to be more favourable than expected.

Companies therefore face the dilemma of choosing between a steady, predictable performance, versus the opportunity cost if exchange rates are better than expected.

Using currency options provided by the currency specialist, companies have a solution to this dilemma.

On the other hand, hedging could result in the company not getting the windfalls of more cash and more profit if exchange rates turn out to be more favourable than expected.

Companies therefore face the dilemma of choosing between a steady, predictable performance, versus the opportunity cost if exchange rates are better than expected.

Using currency options provided by the currency specialist, companies have a solution to this dilemma.

Currency options

In essence, currency options enable companies to insure against less cashflow and profits from unfavourable future exchange rates, but also allow companies to receive more cash and make more profit from favourable future exchange rates.

Like insurance on a house or car, currency options are not free, however the currency specialist has a range of options and other hedging instruments that mean the premium can be adjusted or avoided entirely to suit your budget, risk profile, and outlook for the path of exchange rates.

Currency options and other financial derivatives have been described as "weapons of mass destruction". That is unfair considering these instruments effectively insure companies from the consequences of exchange rate volatility: loss of cashflow and profits and even the entire business through insolvency. It is fair in the sense some companies have improperly used them and have destroyed the value of their companies as a result. For examples of derivative disasters and to learn how not to use derivatives, contact me or read my articles in the News page.

Like insurance on a house or car, currency options are not free, however the currency specialist has a range of options and other hedging instruments that mean the premium can be adjusted or avoided entirely to suit your budget, risk profile, and outlook for the path of exchange rates.

Currency options and other financial derivatives have been described as "weapons of mass destruction". That is unfair considering these instruments effectively insure companies from the consequences of exchange rate volatility: loss of cashflow and profits and even the entire business through insolvency. It is fair in the sense some companies have improperly used them and have destroyed the value of their companies as a result. For examples of derivative disasters and to learn how not to use derivatives, contact me or read my articles in the News page.

Compare your hedging options - for free and no obligation

To find out how options and other hedging instruments compare to a fixed exchange rate alternative hedge, contact me now, without obligation or charge.