Welcome to Currency Services

Clarity Value Trust Independence

Whether you're acting on behalf of a business or personally, you can lose cash or profit when dealing in foreign currency, because you did not realise you are at risk or you did not properly manage your currency risks.

The aim of Currency Services is to assist you with your currency needs, whether that is physically transferring foreign currency from one place to another, or protecting against adverse effects of currency exchange rate movements.

You can also lose significant value by not choosing the right currency service provider for your needs. A survey carried out for currency specialist OFX, showed that 80% of consumers were unaware of high bank margins on currency conversions. According to OFX, these margins equate to roughly $500 on a $10,000 transfer.

Another currency specialist, MFX, came to a similar conclusion about banks and their currency exchange rates, saying: "with a £10,000 transaction to US dollars, banks could add a margin of up to 5 per cent on the interbank rate, in addition to their transaction fee".

Don't think you'll get your currency converted or transferred for free with a currency service provider or agent. They are, like banks, in business to make money from the services they provide to you.

Their profit could be from charging you a margin (smaller than banks charge, but not necessarily smaller) when converting your money, from the fee you pay them to transfer your money (again, not necessarily smaller than charged by banks), or just for referring you to their outsourced currency service provider.

With so many currency service providers and intermediaries to choose from, in addition to the banks, it can seem daunting to know which one is the optimum for you in terms of service, product, and cost. That is where Currency Services can help. Contact Currency Services today for a free no-obligation consultation to understand the currency risks you face and how to exchange and transfer money internationally.

The aim of Currency Services is to assist you with your currency needs, whether that is physically transferring foreign currency from one place to another, or protecting against adverse effects of currency exchange rate movements.

You can also lose significant value by not choosing the right currency service provider for your needs. A survey carried out for currency specialist OFX, showed that 80% of consumers were unaware of high bank margins on currency conversions. According to OFX, these margins equate to roughly $500 on a $10,000 transfer.

Another currency specialist, MFX, came to a similar conclusion about banks and their currency exchange rates, saying: "with a £10,000 transaction to US dollars, banks could add a margin of up to 5 per cent on the interbank rate, in addition to their transaction fee".

Don't think you'll get your currency converted or transferred for free with a currency service provider or agent. They are, like banks, in business to make money from the services they provide to you.

Their profit could be from charging you a margin (smaller than banks charge, but not necessarily smaller) when converting your money, from the fee you pay them to transfer your money (again, not necessarily smaller than charged by banks), or just for referring you to their outsourced currency service provider.

With so many currency service providers and intermediaries to choose from, in addition to the banks, it can seem daunting to know which one is the optimum for you in terms of service, product, and cost. That is where Currency Services can help. Contact Currency Services today for a free no-obligation consultation to understand the currency risks you face and how to exchange and transfer money internationally.

Don't know what to do about your currency risk or a currency transfer?

Here are some pointers to get you started...

Don't... |

Do... |

bury your head in the sand, or close your eyes and hope you get a good exchange rate. |

ask for an independent assessment of what your bank is proposing to you, at what cost, and on what terms and conditions. |

be a victim of pressure selling and be forced into buying hedging financial instruments as a condition of getting a loan (remember the interest rate swaps scandal?) |

get an alternative currency exchange rate quote. |

take the first currency exchange rate quoted by your bank |

get in touch for a free initial consultation, without obligation |

think currency markets are forgiving |

ask for clarification on currency jargon or currency risk management |

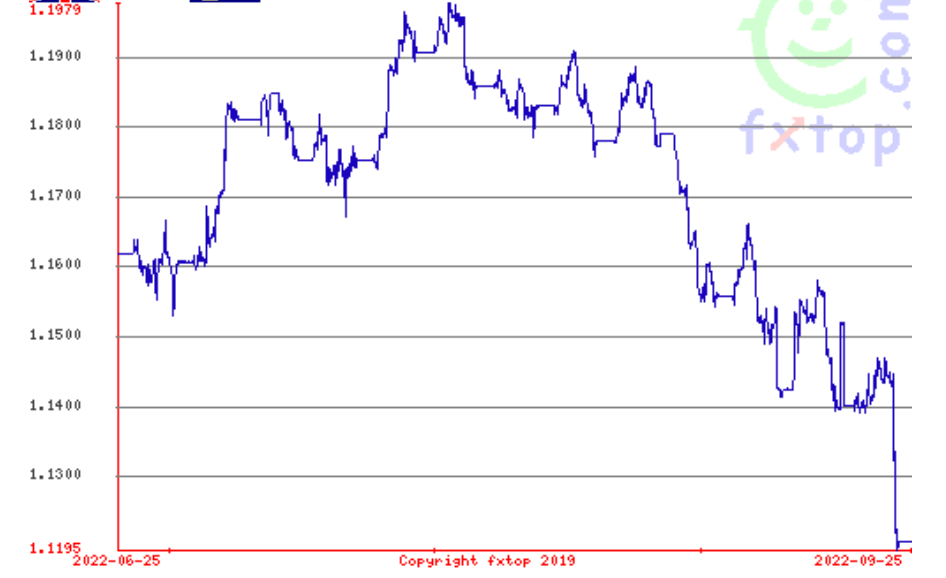

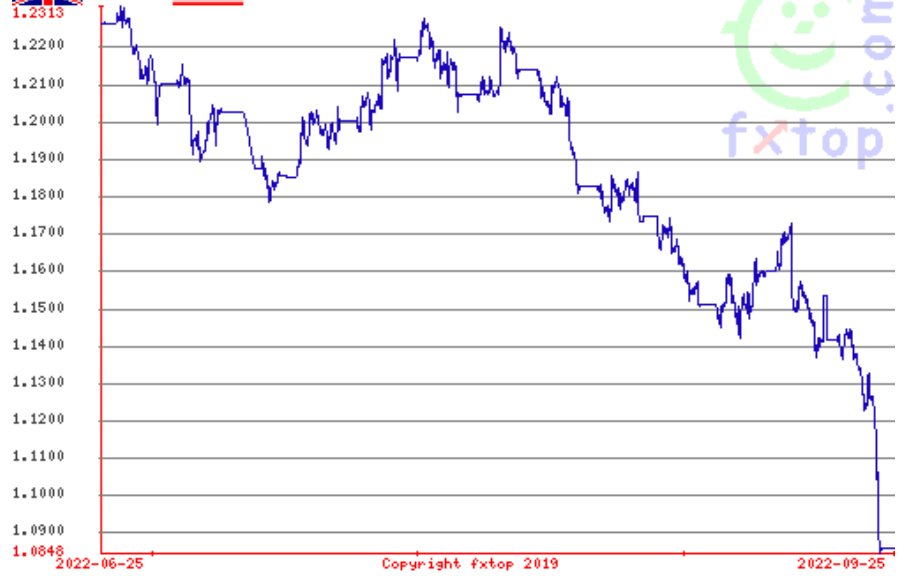

£ takes a tumble against $ and €

The first chart below shows how £ has depreciated rapidly against € in September 2022, which is in contrast to how it had actually appreciated against the € in July. The second chart shows £ has continued its depreciation against the $, but as with the €, that depreciation has been rapid and large, and the currency has fallen off a cliff against € and $ in September. (data source:FXtop.com)

The cause? Inflation, energy crisis, a looming recession, massive fiscal borrowing, and tax cuts announced by the revamped UK government, and the relative strength of the US economy and its safe-haven status.

Winners in £'s depreciation are UK exporters but their gains will be diminished by higher input costs of imported materials used to make their exported products. Importers that sell into the UK domestic market will be worse off as they suffer higher costs of imports whilst generating revenue in £ only.

All companies will not relish the greater currency volatility because it makes budgetting, planning and pricing of goods and services harder to forecast with confidence. Not all will be able to pass on higher input costs to end users, which means smaller profit margins if any. For some, producing goods is no longer economically viable so they have had to cut back operating capacity until input prices reduce. With the state and outlook of global markets and the UK economy, that reversion to the mean is not likely to happen this year and 2023 is not looking any better. All of which means individuals and companies trading and dealing internationally, need to take more care when buying and selling currencies and planning their receipts and payments.

Currency Services offers currency risk management services and can facilitate international transfers. Get in touch for a free no-obligation discussion on avoiding costs or saving money.

The cause? Inflation, energy crisis, a looming recession, massive fiscal borrowing, and tax cuts announced by the revamped UK government, and the relative strength of the US economy and its safe-haven status.

Winners in £'s depreciation are UK exporters but their gains will be diminished by higher input costs of imported materials used to make their exported products. Importers that sell into the UK domestic market will be worse off as they suffer higher costs of imports whilst generating revenue in £ only.

All companies will not relish the greater currency volatility because it makes budgetting, planning and pricing of goods and services harder to forecast with confidence. Not all will be able to pass on higher input costs to end users, which means smaller profit margins if any. For some, producing goods is no longer economically viable so they have had to cut back operating capacity until input prices reduce. With the state and outlook of global markets and the UK economy, that reversion to the mean is not likely to happen this year and 2023 is not looking any better. All of which means individuals and companies trading and dealing internationally, need to take more care when buying and selling currencies and planning their receipts and payments.

Currency Services offers currency risk management services and can facilitate international transfers. Get in touch for a free no-obligation discussion on avoiding costs or saving money.

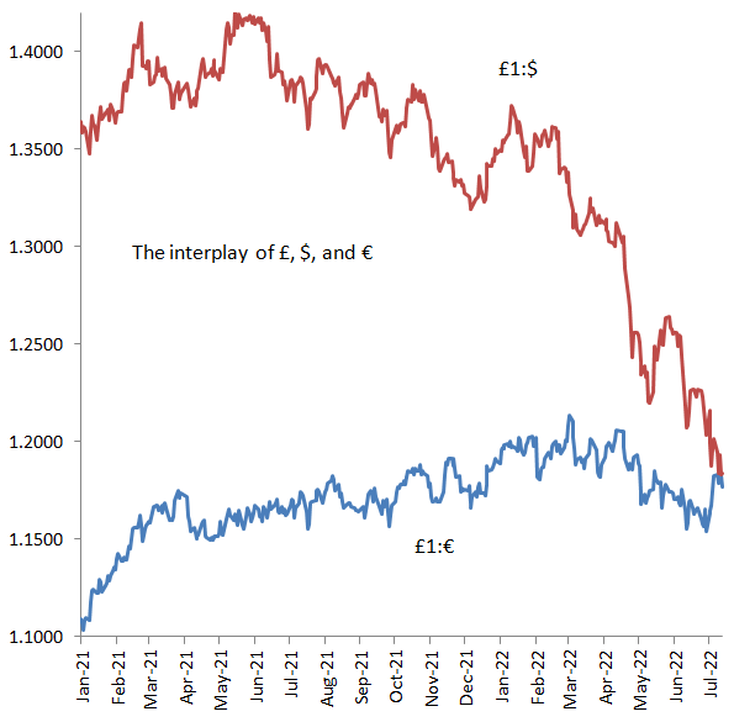

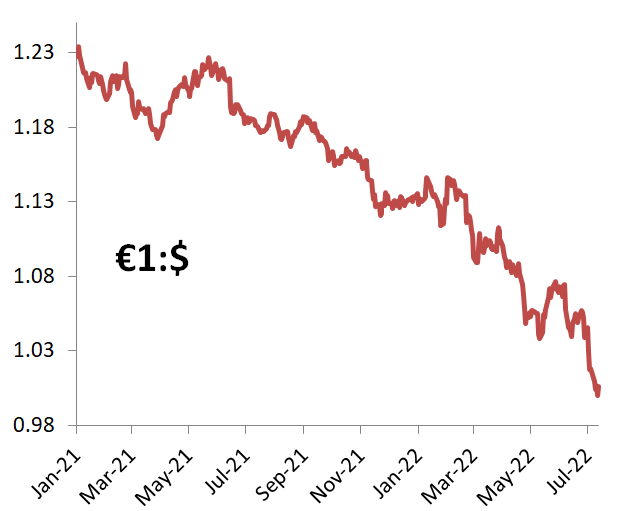

Staying afloat in a currency storm: the interplay of £, €, and $ exchange rates

The first chart below shows that in July 2022, the € depreciated to €1:$1.00, reflecting the currency market's fears over the adverse effects of inflation, recession, interest rates, soaring energy prices and energy rationing, on businesses and consumers across the Eurozone. As is often the case, the US economy and $ assets have been seen as relatively safe havens during geopolitical tensions and market volatility, and so the flight to buying the $ in preference to the €.

The second chart below shows how the UK Pound has appreciated against the € but, like the €, has depreciated against the $, for the same reasons cited above for the €, except perhaps that the UK is not as dependent as the EU has become, on Russian oil.

The second chart below shows how the UK Pound has appreciated against the € but, like the €, has depreciated against the $, for the same reasons cited above for the €, except perhaps that the UK is not as dependent as the EU has become, on Russian oil.

Ref: Charts by Currency Services using data derived from currency data supplied by the ECB

Currency volatility and the consequences of not hedging.

What does currency volatility mean for businesses that do not hedge? In a word, risk.

Risk of generating less cash than expected, which can lead to pressure to pay creditors as they fall due, breaches of covenants, inability to tender for contracts or to fulfil existing contracts, inability to pay staff, or to pay for stocks.

In addition to the negative cashflow, reported earnings can fall, which can send out the wrong signals to potential lenders, trade suppliers, and customers.

Auditors might refuse to sign-off accounts if they have doubts about the going-concern status of the business or its ability to provide working capital for the next year. Without audited accounts, suppliers might reduce credit terms or insist on cash on delivery. Lenders might charge higher interest rates, insist on greater security, refuse to lend, or call in their loans.

Employees might abandon ship, lose morale, or refuse to take a cut in salaries to conserve cash. Redundancy costs can be expensive and a further drain in cashflow.

Risk of generating less cash than expected, which can lead to pressure to pay creditors as they fall due, breaches of covenants, inability to tender for contracts or to fulfil existing contracts, inability to pay staff, or to pay for stocks.

In addition to the negative cashflow, reported earnings can fall, which can send out the wrong signals to potential lenders, trade suppliers, and customers.

Auditors might refuse to sign-off accounts if they have doubts about the going-concern status of the business or its ability to provide working capital for the next year. Without audited accounts, suppliers might reduce credit terms or insist on cash on delivery. Lenders might charge higher interest rates, insist on greater security, refuse to lend, or call in their loans.

Employees might abandon ship, lose morale, or refuse to take a cut in salaries to conserve cash. Redundancy costs can be expensive and a further drain in cashflow.

Opportunity cost versus stability

Hedging removes risk of loss of cash and profit and so removes the adverse effects described above if exchange rates turn out to be unfavourable.

On the other hand, hedging could result in the company not getting the windfalls of more cash and more profit if exchange rates turn out to be more favourable than expected.

Companies therefore face the dilemma of choosing between a steady, predictable performance, versus the opportunity cost if exchange rates are better than expected.

Currency options are a solution to this dilemma.

On the other hand, hedging could result in the company not getting the windfalls of more cash and more profit if exchange rates turn out to be more favourable than expected.

Companies therefore face the dilemma of choosing between a steady, predictable performance, versus the opportunity cost if exchange rates are better than expected.

Currency options are a solution to this dilemma.

Currency options

In essence, currency options enable companies to insure against less cashflow and profits from unfavourable future exchange rates, but also allow companies to receive more cash and make more profit from favourable future exchange rates.

Like insurance on a house or car, currency options are not free, however their terms can be adjusted according to budget, risk profile, and outlook for the path of exchange rates.

Like insurance on a house or car, currency options are not free, however their terms can be adjusted according to budget, risk profile, and outlook for the path of exchange rates.