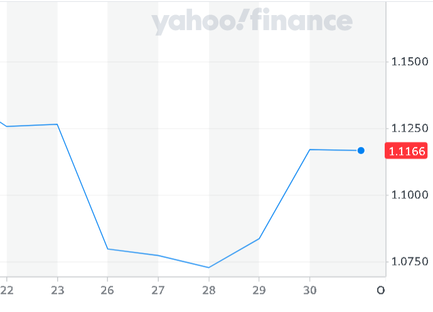

According to EUBusiness, the release of better than expected UK GDP numbers (UK growth in Q2 was 4.4% versus an expected 2.9% growth), plus the intervention on Wednesday by the Bank of England and its short term Gilt buying programme, helped GBP appreciate and recover some of its lost value against USD. The options market, however, suggests there is still a 30% chance that GBP USD could fall below parity by year end. The chart opposite (YahooFinance), shows £1:$ in the last week of Sep 2022, and the depreciation of £ to $1.07 followed by its swift appreciation to $1.12 GBP USD Parity will mean higher costs in GBP for UK importers, so lower corporate profits where these costs cannot be fully passed on to consumers. Higher consumer prices means inflation and that will probably deter spending, which will lead to further drops in corporate profits. Higher inflation could mean more increases in interest rates by the UK central bank, putting further pressure on heavily-indebted companies and consumers, and adding to the interest to pay on higher UK government debt announced by the UK government in its recent mini-budget. Currency risk is not going to go away and is likely to warrant closer attention by companies and individuals exposed to the risks of paying too much or receiving too little for their currency transactions. Contact Currency Services today for a free no-obligation consultation on your business or personal currency transactions Comments are closed.

|